The importance of online tools for insurance brokers in the modern insurance world cannot be overemphasized. Technology is now playing a major role in changing the way insurance services are administered and provided, thanks to the digital revolution.

Importance of Online Tools for Insurance Agents

Online tools have completely changed the way insurance brokers work and given them access to previously unheard-of benefits. These solutions act as catalysts for efficacy and efficiency, empowering agents to increase output, optimize workflows, and deliver better services to their customers. These tools are now the foundation of contemporary insurance companies, used for everything from policy management to channel optimization.

Role of Technology in the Insurance Industry

The revolutionary shifts in the insurance industry are primarily the result of technological advancements. The industry has undergone a paradigm shift as a result of the introduction of creative digital solutions. In addition to making complicated jobs simpler, automation, data analytics, and seamless communication tools have created new opportunities for tailored consumer experiences. To stay ahead in a fiercely competitive industry, adopting technology has become second nature; thus, insurance agents must capitalize on these developments if they want to prosper in the digital era.

Insurance Agent Software

Definition and Benefits of Insurance Agent Software

Features and Functionalities of Insurance Agent Software

Client Management: With the use of insurance agent software, agents can keep thorough customer records that include policy details, correspondence history, and renewal dates. Easy access to vital information is ensured by this unified database.

Policy Management: Insurance policies are easily created, updated, and managed by agents. The program facilitates the efficient generation of quotes, policy issuance, endorsement processing, and renewal processing.

Document Management: It is simple to store and arrange crucial papers, like contracts, claims, and client data. Agents will always be able to easily obtain the required documents thanks to this functionality.

Communication Tools: Email templates and messaging systems are two integrated communication options that are available in many insurance agent software solutions. These solutions facilitate quick responses to inquiries and improve client communication.

Reporting and Analytics: Agents are able to examine data trends and produce comprehensive reports. This analytical understanding helps in understanding customer behavior, spotting market trends, and making well-informed company decisions.

Popular Insurance Agent Software Names

Tool 1: InsureHub

Insurance agents seeking all-inclusive software solutions choose InsureHub because of its intuitive UI, strong policy management, and perceptive analytics.

Tool 2: PolicyPro

Policy design and management are PolicyPro areas of expertise. It is a useful tool for agents handling a variety of insurance products because of its user-friendly features and adaptable templates.

Tool 3: Agent360

Agent360 provides a comprehensive solution by integrating effective communication tools, document organization, and client management. Because of its mobile compatibility, agents may remain linked while on the go.

Insurance agents may improve customer happiness, streamline operations, and maintain their competitiveness in the digital world with the help of these software tools.

Digital Tools for Insurance Agents

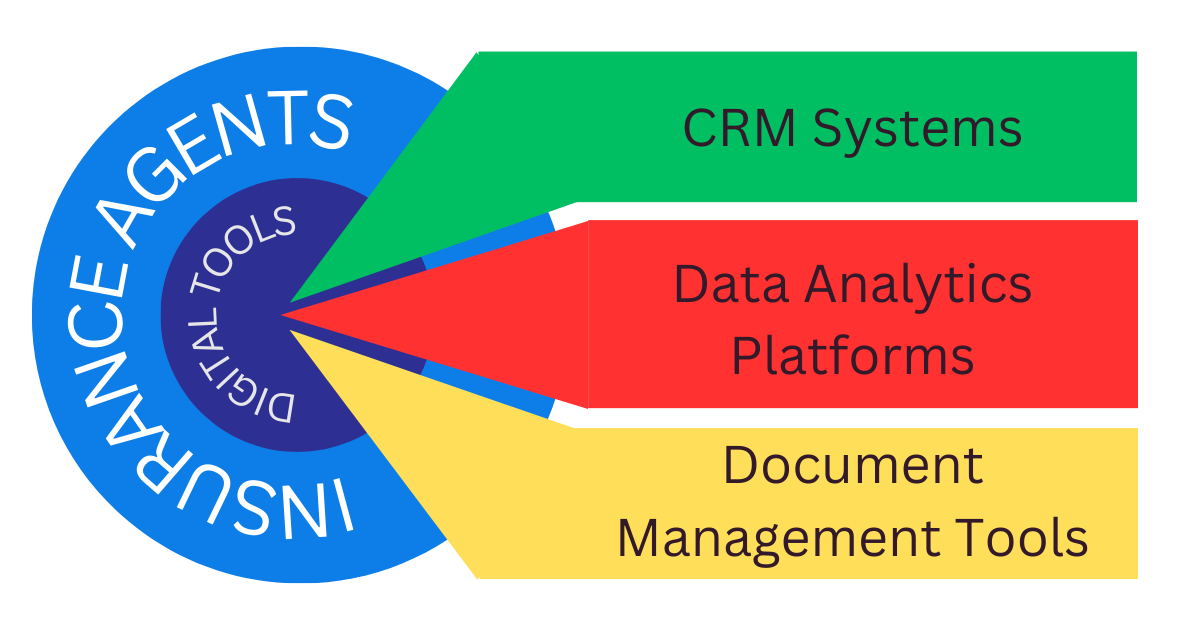

Overview of Various Digital Tools Available for Insurance Agents

Insurance agents now have access to a wide range of effective tools that are intended to improve production and efficiency, thanks to the digital revolution. These solutions increase client happiness and loyalty in addition to streamlining daily operations. Insurance agents now have access to a wide range of tools catered to their individual requirements, including data analytics platforms and customer relationship management (CRM) systems.

Importance of Digital Tools in Streamlining Insurance Operations

These days, digital instruments are the backbone of insurance operations. Through data analysis, they offer priceless insights, automate laborious operations, and enable smooth communication. Insurance agents can streamline their operations, cut down on administrative costs, and devote more time to developing deep connections with clients by utilizing these technologies. Additionally, digital tools improve precision, guaranteeing that insurance is properly customized to meet the needs of each unique client.

Examples of Digital Tools for Insurance Agents

CRM Systems: Customer relationship management platforms such as Salesforce and HubSpot facilitate the effective management of client interactions, lead tracking, and customer relationship cultivation by agents. These systems allow for automated follow-up procedures and customized communication.

Data Analytics Platforms: Agents can make data-driven judgments with the help of programs like Tableau and Google Analytics. Through the examination of customer data and industry trends, agents may improve client happiness, hone their tactics, and spot possibilities for growth.

Document Management Tools: Digital document signing is made easier by platforms like Adobe Sign and DocuSign. In addition to saving time, this also lessens the need for paper, supporting environmentally beneficial practices.

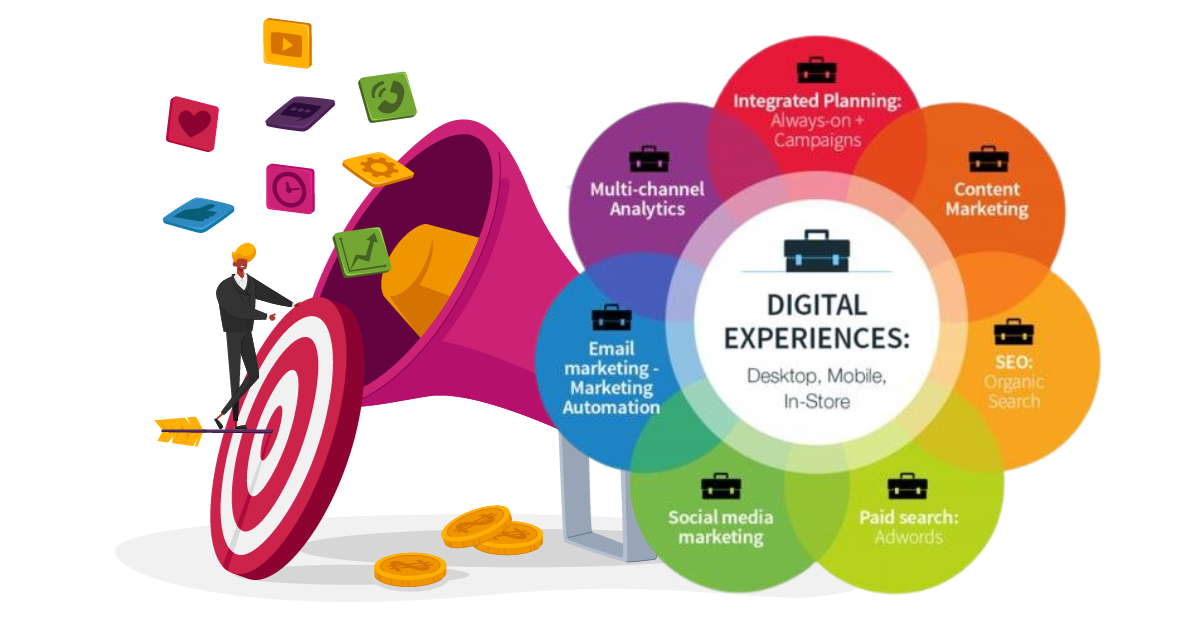

Digital Marketing Tools

Role of Digital Marketing in the Insurance Sector

The insurance sector has evolved to rely heavily on digital marketing, which has completely changed the way agents connect with potential customers, cultivate relationships, and advertise their services. Consumers are spending more and more on internet resources in the digital era to investigate insurance possibilities and make wise choices. As a result, insurance brokers must use digital marketing techniques to maintain their relevance and competitiveness in the industry.

Online Marketing Tools for Insurance Agents

Social Media Marketing

Insurance agents now have effective tools at their disposal to interact with their audience on social media sites. Agents may engage with clients directly, distribute insightful material, and establish a strong online presence by using social media sites like Facebook, Instagram, LinkedIn, and Twitter. Through focused advertising initiatives, social media marketing promotes brand visibility, trust, and lead generation.

Email Marketing

Continues to be an economical and successful method for insurance agents to interact with customers and potential customers. Agents can disseminate policy updates, instructional materials, and exclusive offers via tailored email campaigns. With the use of email marketing solutions, agents can segment their audience and customize messages according to the interests and actions of the recipients. Conversion rates and engagement are increased by this focused strategy.

Content Creation and SEO

For insurance brokers, digital marketing revolves around high-quality content. Agents can position themselves as industry experts and offer helpful resources to prospective clients by producing educational blog posts, articles, videos, and infographics. The agent’s website is more easily found by those looking for information about insurance thanks to search engine optimization (SEO) strategies that improve this content’s online visibility. In order to guarantee that the material appears highly on search engine results pages, SEO tools help with keyword research, on-page optimization, and backlink analysis.

Insurance agents can reach a wider audience and establish more meaningful interactions with them by using digital marketing tools. Through the utilization of email campaigns, SEO tactics, and social media marketing, agents may create a strong online presence, interact with clients in a productive manner, and eventually increase sales and customer satisfaction.

Conclusion

Ultimately, the incorporation of Internet technologies within the insurance sector is not only a contemporary convenience but also a prerequisite for insurance agents who aim to maximize productivity and satisfy clients. Accepting these tools gives agents the ability to improve client encounters, expedite operations, and remain competitive in a world going more digital.

Insurance agents may guarantee improved customer service, precise policy administration, and strong cybersecurity by adjusting to technological breakthroughs. This will finally result in a prosperous and competitive insurance industry.

[FAQ]

What types of online tools can insurance agents use to improve their productivity?

Insurance agents can use various online tools, including customer relationship management (CRM) software, lead generation platforms, insurance quoting tools, policy management software, and communication platforms to streamline their work processes and enhance productivity.

How do online tools for insurance agents impact customer service and client relationships?

Online tools can enhance customer service by providing quick access to information, streamlining communication, and improving response times. This, in turn, can help strengthen client relationships and trust.

I’m a regular blogger, and I must say, I adore reading your posts. My interest has been piqued by the article. I’m going to save your blog to my bookmarks and check again for fresh content.

Thank you so much

I appreciate you sharing this blog post. Thanks Again. Cool.

Thank you so much

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Thank you so much

very informative articles or reviews at this time.

Thank you so much