Because they make it possible to own and exchange digital assets uniquely, non-fungible tokens, or NFTs, have completely changed the digital world. Particularly in the art and collectibles industry, this cryptography technology has become incredibly popular, enabling producers to make money off of their creations and providing collectors with never-before-seen possibilities. We will discuss the basics of NFTs in this post, including their definition, methods of operation, and several revenue streams. This tutorial will give you insights into the fascinating world of NFTs and how to manage their potential for receiving more money, whether you’re an investor, collector, or artist.

Definition of NFTs (Non-Fungible Tokens)

In recent times, non-fungible tokens, or NFTs for short, have become extremely popular in the digital world. Whether it’s a tweet, in-game items, virtual property, music, artwork, or any other type of digital asset, these distinctive digital assets serve as ownership or authenticity proof for that particular thing. Because of their unique characteristics, NFTs cannot be swapped one-to-one like cryptocurrencies like Bitcoin or Ethereum. Instead, they are indivisible. Blockchain technology ensures the scarcity and immutability of NFTs when they are created. Every NFT is unique—a digital collectible that sets it apart from all others with its unique cryptographic signature. Due to their distinctiveness, NFTs have become wildly popular and are being created and traded by artists, creators, and collectors alike.

The market for digital art and collectibles seeing growth in NFTs

The NFT craze’s influence on the art and collectibles industry has been one of its main catalysts. With the ability to sell their work as NFTs, digital artists and content providers may now generate additional income without the need for middlemen. The art industry has become more democratic as a result of this change, giving artists more autonomy over their works and income. At the same time, collectors have rushed to NFT marketplaces to buy one-of-a-kind products and digital art, with some NFTs selling for millions of dollars. Art and collectibles now have a new dimension thanks to the NFT market, where the value is determined by the digital assets’ uniqueness and rarity in addition to their aesthetic appeal.

The potential for individuals to make money with NFTs

Many people are eager to investigate how they might profit from this emerging field, given the growing interest and passion surrounding NFTs. Whether you’re an investor intending to take part in the NFT market or an artist or collector, this article will walk you through the different ways you can use NFTs to generate income. We’ll examine the opportunities and possible hazards in the realm of non-fungible tokens, from producing and offering NFTs to trading and investing in them. Continue reading to learn more about the realm of receiving money with NFTs if you’re interested in learning how to convert your digital assets into digital income.

How do NFTs work?

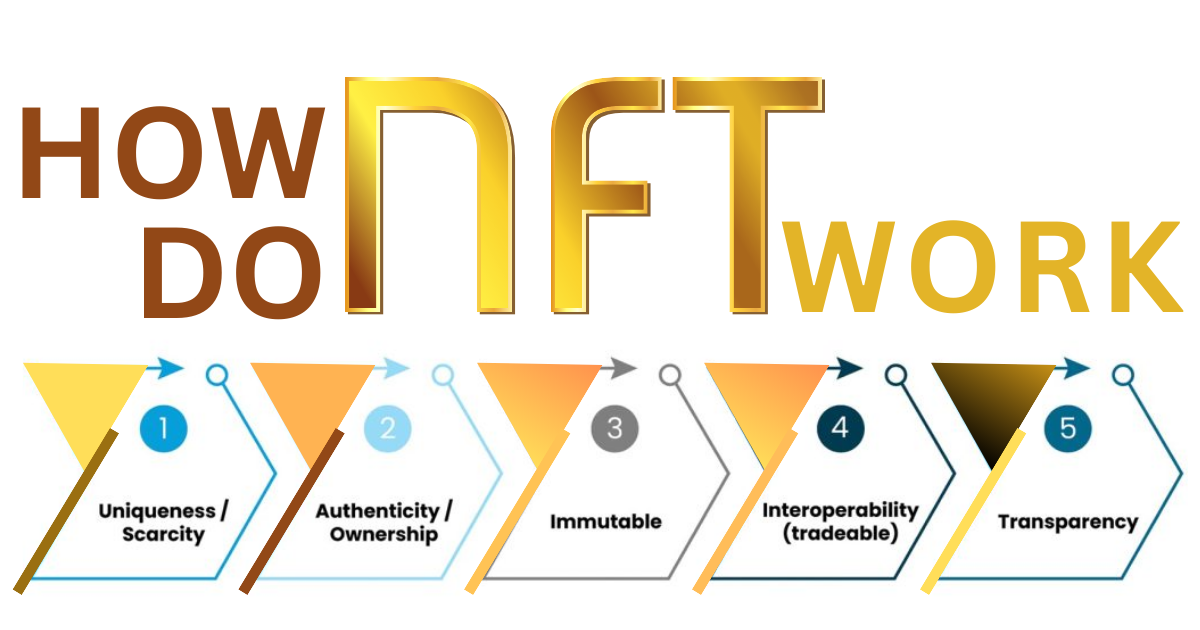

Non-fungible tokens, or NFTs for short, are a special kind of digital asset that has attracted a lot of interest lately. NFTs, in contrast to more established cryptocurrencies like Bitcoin and Ethereum, are indivisible and unique from one another. Blockchain technology is used in the creation of these digital tokens, guaranteeing their immutability, provenance, and scarcity. NFTs are essentially digital certificates of ownership that confirm an item’s uniqueness and authenticity using cryptographic signatures. These certificates can be used for digital artwork, collectible trading cards, virtual real estate parcels, or any other type of digital or physical property.

The fundamental idea underlying NFTs is that they are unique and cannot be traded for another in a like-for-like fashion. They are extremely precious and appealing to both producers and collectors because of their distinctiveness. An NFT is digital evidence of ownership and validity for a specific item that is owned by the owner and recorded on the blockchain, which makes it transparent and safe.

The ownership and distinctiveness of NFTs

The distinctiveness of NFTs is one of their distinguishing qualities. Every NFT is unique from other tokens thanks to its unique identifier and metadata. Because collectors are willing to pay for something that cannot be duplicated or counterfeited, NFTs’ uniqueness is what makes them valuable.

Another important component of NFTs is their ownership component. You have unquestionable, verifiable ownership rights to the related physical or digital asset when you possess an NFT. Since this ownership is documented on the blockchain, it is transparent and impervious to manipulation. Because NFTs are easily moved, sold, or exchanged on several NFT marketplaces, they have afforded producers and collectors more ownership and sovereignty over their digital art and treasures.

Different kinds of NFTs

NFTs now cover a broad spectrum of assets, going beyond digital art and collectibles. Typical NFT types include the following:

Digital Art: By minting their works as NFTs, artists can directly sell their masterpieces to collectors.

Music: Artists and producers now have a new avenue for distribution and revenue generation when they release singles and albums as NFTs.

Virtual Real Estate: NFT-based virtual land and property ownership is available on metaverse and virtual world platforms.

Gaming: NFTs can be used to tokenize in-game goods, skins, and characters, enabling players to buy, sell, and exchange these assets.

Collectibles: Virtual pets, trade cards, and stamps are a few examples of unique and collectible goods that NFTs can symbolize.

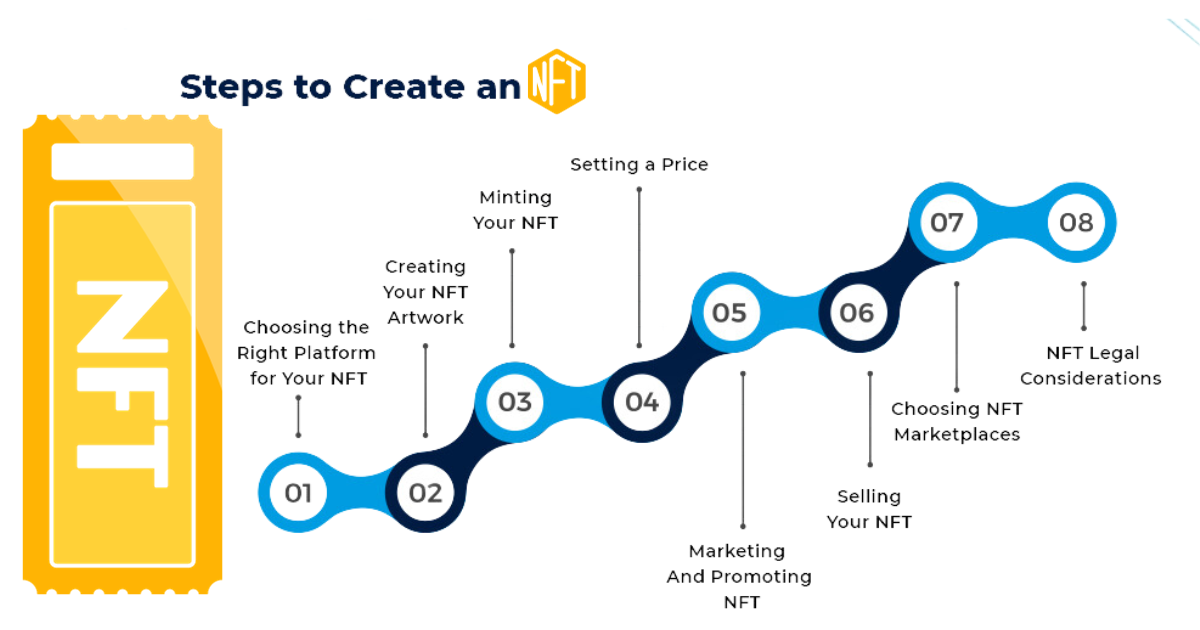

Steps to create your own NFT

If you’re an artist, musician, or content producer, creating your own NFT is a terrific opportunity to take advantage of the NFT market and make some extra cash. It’s also a really simple procedure. The main actions to make your own NFT are as follows:

- Selecting a Blockchain: Choose a blockchain platform that facilitates NFTs; two well-liked options are Ethereum and Binance Smart Chain. The ERC-721 and ERC-1155 standards for Ethereum are frequently utilized for creating NFTs.

- Establish a virtual wallet: A digital wallet that works with the selected blockchain is required. Your NFTs will be stored here, along with transaction processing. Trust Wallet and MetaMask are two well-liked wallet choices.

- Fill your pocketbook: Make sure you have cryptocurrency in your wallet; for Ethereum-based NFTs, this is usually Ether (ETH). To pay for the NFT creation fees, you’ll need some cryptocurrency.

- Selecting an NFT Marketplace: You can mint NFTs and post them for sale on a number of NFT markets, including OpenSea, Rarible, and Mintable. Select a marketplace where your audience and content fit well.

- Chop Up Your NFT: Making a token on the blockchain to represent your digital asset is known as minting an NFT. Usually, metadata for your NFT is required, including a title, description, and digital file.

- Defined parameters: Choose whether your NFT will be a one-of-a-kind or a limited-edition piece. Additionally, you have the option to set royalties, which entitles you to a portion of NFT sales going forward.

- Remit mining charges: There are mining and gas expenses related to each blockchain. To complete the creation of your NFT, have these fees ready to be paid.

- For Sale List: After your NFT is created, you may list it on the market and specify the amount you want to charge for it.

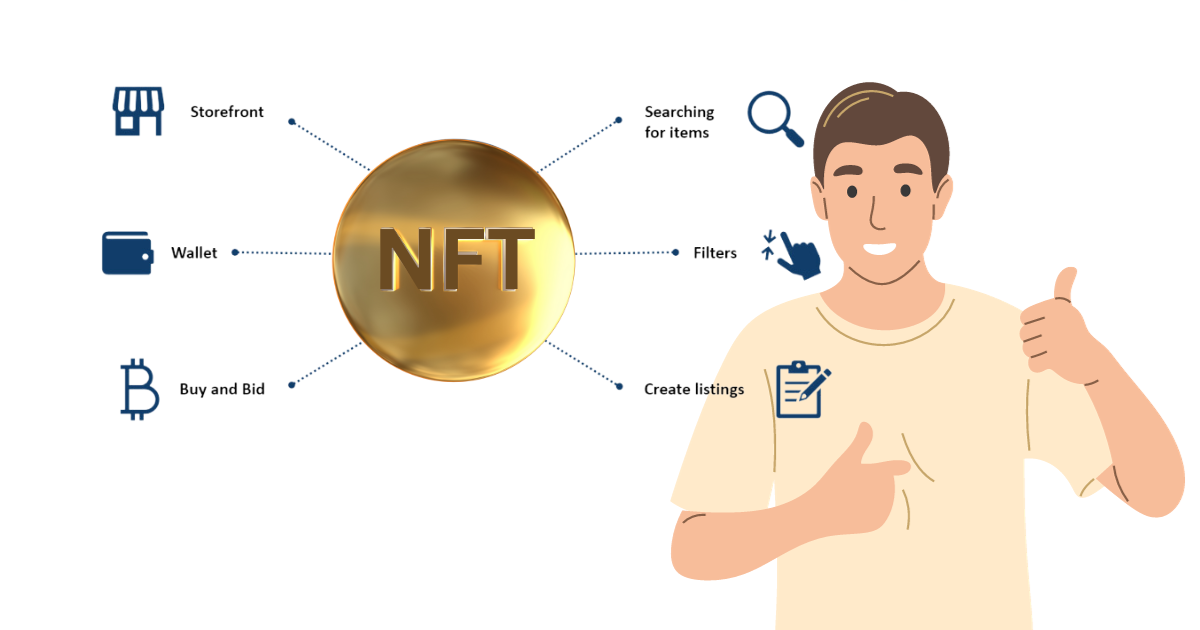

Websites and markets where NFTs can be minted

For minting NFTs, a number of blockchain platforms and markets provide the following resources and services:

- Blockchain: The most popular blockchain for creating NFTs is Ethereum. It provides a number of NFT creation standards, such as ERC-1155 and ERC-721.

- OpenSea: NFT minting services are provided by OpenSea, one of the biggest and most well-known NFT marketplaces.

- Rarible: Another well-known NFT marketplace where users can generate and mint their NFTs is Rarible.

- Mintable: Without knowing how to code, developers can easily mint NFTs with the help of the platform Mintable.

- Mintbase: Based on the Tezos blockchain, Mintbase is an NFT minting platform.

- SuperRare: SuperRare is a digital art NFT platform that enables artists to mint and sell their one-of-a-kind works.

- Foundation: Through the social NFT platform Foundation, creators can mint NFTs, which the public can then bid on.

- Zora: Zora is a decentralized NFT marketplace that strives to be more community- and artist-focused.

- NBA Top Shot: Basketball enthusiasts may purchase, trade, and fans legally licensed NBA collectible highlights on NBA Top Shot, an NFT platform.

Easy-to-use interfaces are offered for minting and selling NFTs on marketplaces such as OpenSea, Rarible, and Mintable. Your preferences, your target market, and the kind of material you wish to tokenize will all influence the platform and marketplace you choose.

Improving the creation and metadata of NFTs

Take into account the following advice to enhance your success when producing NFTs:

Superior Content: Make sure the digital product you’re tokenizing is relevant to your audience and of the highest caliber. It ought to be interesting and different.

Activating Metadata: Provide enticing metadata, such as a thorough description, a catchy title, and any pertinent NFT background data. Captivating metadata can draw in customers.

Promotion and Marketing: Promote your NFTs using social media and other marketing avenues. Create excitement for your NFT drops by interacting with your audience.

Partnerships: Work along with other creatives to broaden your audience and possibly reach their already-existing fan following.

Buying and Selling NFTs

Purchasing and selling digital assets has emerged as a dynamic and perhaps lucrative activity in the NFT environment. Knowing your way around the NFT market is crucial for success, whether you’re an investor, collector, or art fan. The following summarizes the main elements of purchasing and selling NFTs:

Buying NFTs

In order to purchase NFTs, you must first have a digital wallet that is compatible. Coinbase Wallet, Trust Wallet, and MetaMask are a few of the well-known wallets. You can browse NFT marketplaces like OpenSea, Rarible, and NBA Top Shot, where a range of digital assets are posted for sale, once your wallet is set up and financed with cryptocurrency. Think about things like your preferences, the item’s rarity, and the creator’s reputation while purchasing an NFT.

Selling NFTs

You can list your own NFTs on NFT markets if you’ve made them or if you’ve obtained digital assets you’d like to sell. It’s important to set the proper pricing, and you can do so by consulting the most recent sales information of NFTs that are comparable. Furthermore, think about whether you want to establish royalties for subsequent sales so that you can get paid a portion when the NFT is transferred. In order to draw in potential customers, marketing and advertising are also essential, and social media platforms are frequently utilized for this.

Trading NFTs

Buying and selling NFTs is not the only way to trade them. They are also exchangeable. Trading is a hobby for certain investors and collectors who hunt for chances to trade rare NFTs for other items. Trading can be a speculative endeavor; therefore, it’s critical to establish a plan and thoroughly investigate any NFTs you’re interested in.

Assessing NFT Investments

Due diligence must be done if you’re thinking about making NFT investments. Evaluate the market trends, the creator’s reputation, and the NFT’s possible long-term value. NFTs are risky investments, just like any other, and the market may be very speculative. These hazards can be managed with the aid of diversification and a long-term outlook.

It’s critical to stay educated and make wise selections while purchasing and disposing of these digital assets in this quickly changing NFT market. The section that follows will examine different approaches to NFT monetization and provide advice for anyone wishing to profit from this dynamic digital market.

NFT Trends and Future Opportunities to Earn More

The NFT market is characterized by rapidly changing trends and a plethora of upcoming opportunities. It’s critical to keep up with the most recent advancements if you want to take advantage of NFTs. Several noteworthy trends are emerging in this field. Virtual real estate on metaverse platforms is gaining popularity due to its potential for social and financial gain. Whether it’s in virtual fashion, gaming, or music, niche-specific NFT marketplaces are making their marks and offering makers and collectors exclusive chances.

Because of their quicker confirmation times and reduced transaction costs, Layer-2 scaling solutions like Optimism and Polygon are becoming more popular, which enhances NFTs’ sustainability and accessibility. NFTs for augmented reality (AR) are becoming more popular and enabling immersive experiences in the real world. By allowing NFTs to function as collateral and take part in DeFi protocols, the interaction of NFTs and DeFi is opening up new possibilities and broadening the financial ecosystem.

Looking ahead, there are a number of opportunities in the NFT space that are ready to be explored. When paired with royalty agreements, licensing NFTs for usage in video games, virtual worlds, and metaverse platforms can be a reliable source of money. The creation of virtual events that are available to NFT owners, such as concerts and art shows via metaverse platforms, is rapidly advancing. Utility NFTs provide a way to create value by giving users access to premium services and content.

Because of the gaming industry’s integration with NFTs for in-game characters and assets, players now have more opportunities to acquire, exchange, and profit from their digital assets outside of the game. Future developments include fractional ownership, NFT loans, and environmental concerns. These avenues present creative approaches to interacting with NFTs and capitalizing on this dynamic digital marketplace. The NFT universe is growing, and there are a plethora of opportunities inside it that are only constrained by creativity and imagination. As such, it’s an area that is ideal for investigation and financial benefit.

Conclusion

In conclusion, for those looking to profit from their distinctive digital assets, the world of NFTs offers an exciting and dynamic environment. For those who are prepared to investigate this emerging digital economy, NFTs provide a multitude of chances for everyone, from artists and creators to collectors and investors. Despite the market’s emphasis on innovation and trends, it’s critical to approach NFTs with knowledge and understanding of both the inherent dangers and potential rewards. Unlocking the full potential of non-fungible tokens will require careful inquiry and flexibility as NFTs continue to transform the way we produce, accumulate, and invest in the digital world.

[FAQ]

Are there any legal or copyright considerations when selling NFTs?

Yes, it’s important to ensure you have the right to sell the digital content you mint as an NFT. Copyright and intellectual property laws apply, so make sure you own the rights to the content or have obtained the necessary permissions.

What are some tips for successful NFT trading?

To succeed in NFT trading, consider the following: Research and understand market trends and popular artists and creators.

Build a strong online presence and engage with the NFT community.

Be patient and strategic in your buying and selling decisions.

Consider the long-term potential of the NFTs you invest in.

How do taxes work with NFT earnings?

NFT earnings may be subject to taxes, depending on your country’s tax laws. Consult a tax professional to understand your tax obligations and how to report NFT earnings correctly.

Hello, thanks for sharing this nice article, I really enjoy your way of writing, can you pleas tell me how to subscribe to your website?

good blog post

good information.

nice post

nice post i liked